If your finance team is moving to or operating on Sage Intacct, you’re likely facing a great deal of pressure. The business is growing, your billing models are evolving, and the company’s expectations around close speed, accuracy, and compliance are rising. But while the business matures, we’re seeing that many finance teams on Sage Intacct are still stitching together billing, collections, revenue recognition, and reporting through a mix of point solutions, spreadsheets, and add-on Sage modules. A workflow like this may suffice today, but it comes at a high operational cost.

That sort of manual, fragmented process slows down the month-end close, increases the risk of errors, and forces lean finance teams to spend hours reconciling instead of guiding strategic decisions.

Today, we’re aiming to change that.

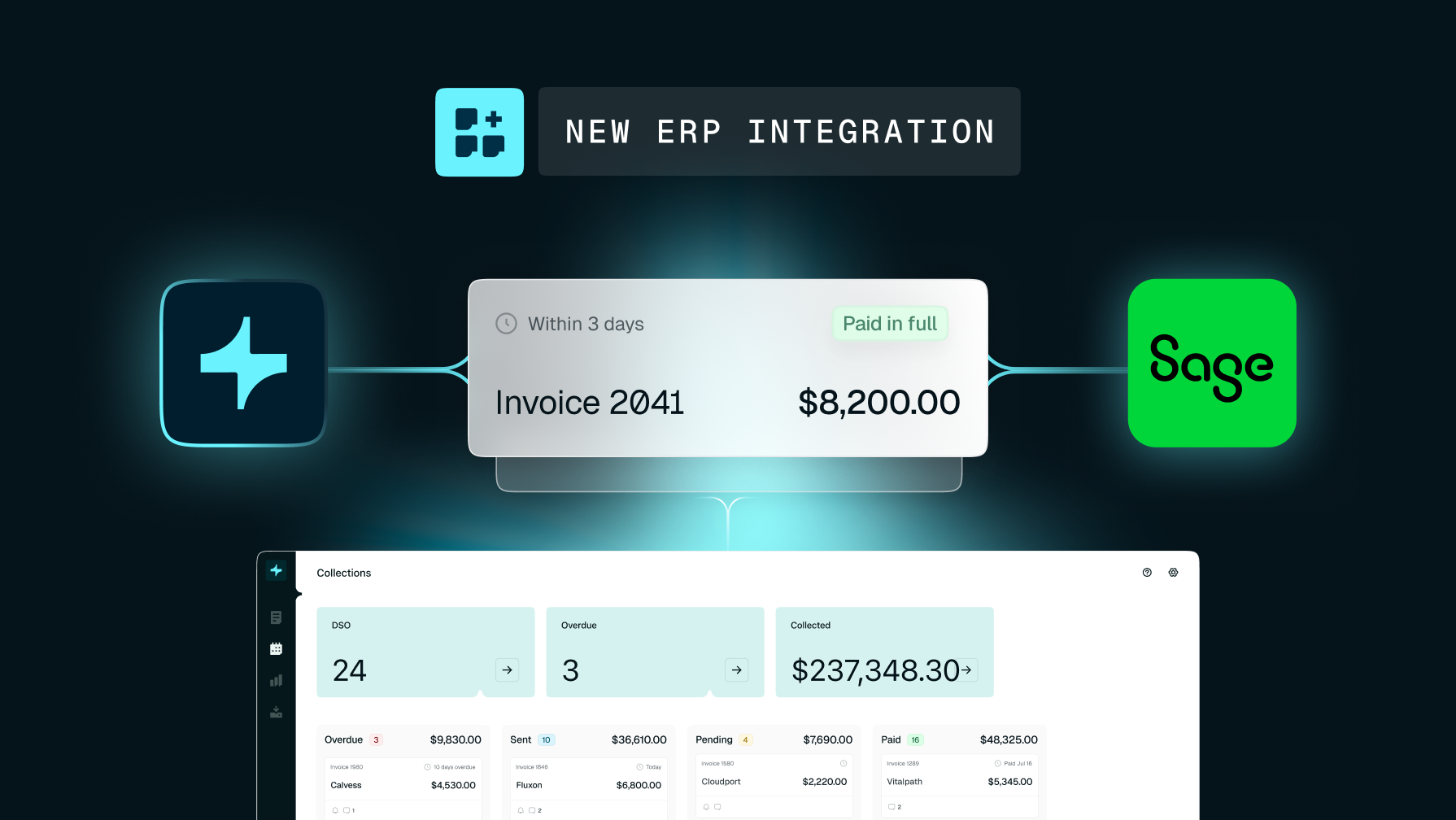

We’re excited to announce our native integration with Sage Intacct, built to give finance teams one unified, automated revenue engine to tackle their entire order-to-cash process.

Bring billing, collections, revenue recognition, and reporting under one roof

Fragmented systems create cracks in the revenue process: duplicated entries go unnoticed, invoices are sent late, payments are not received timely, and revenue schedules don’t line up with contracts, to name a few. Small discrepancies like these compound over time, turning into delayed cash, forecasting blind spots, and painful audit cycles.

With this new integration, finance and accounting teams using Sage Intacct can now use Tabs to automate their billing, collections, revenue recognition, and reporting in a centralized platform all while syncing invoices, payments, and journal entries (coming soon) directly into Sage Intacct. With Tabs as your revenue platform and Sage Intacct as your ERP, your team gets centralized visibility into order-to-cash, with the ability to extend the ERP-functionality of Sage Intacct and add a scalable automation layer that reduces manual work and scales impact of your team.

If you’re a lean Sage-backed finance team looking to save time, get paid faster, and improve billing accuracy, read on to learn how Tabs automates billing and revenue and keeps Sage Intacct up-to-date as your system of record.

Scale Your Team’s Output With Automation

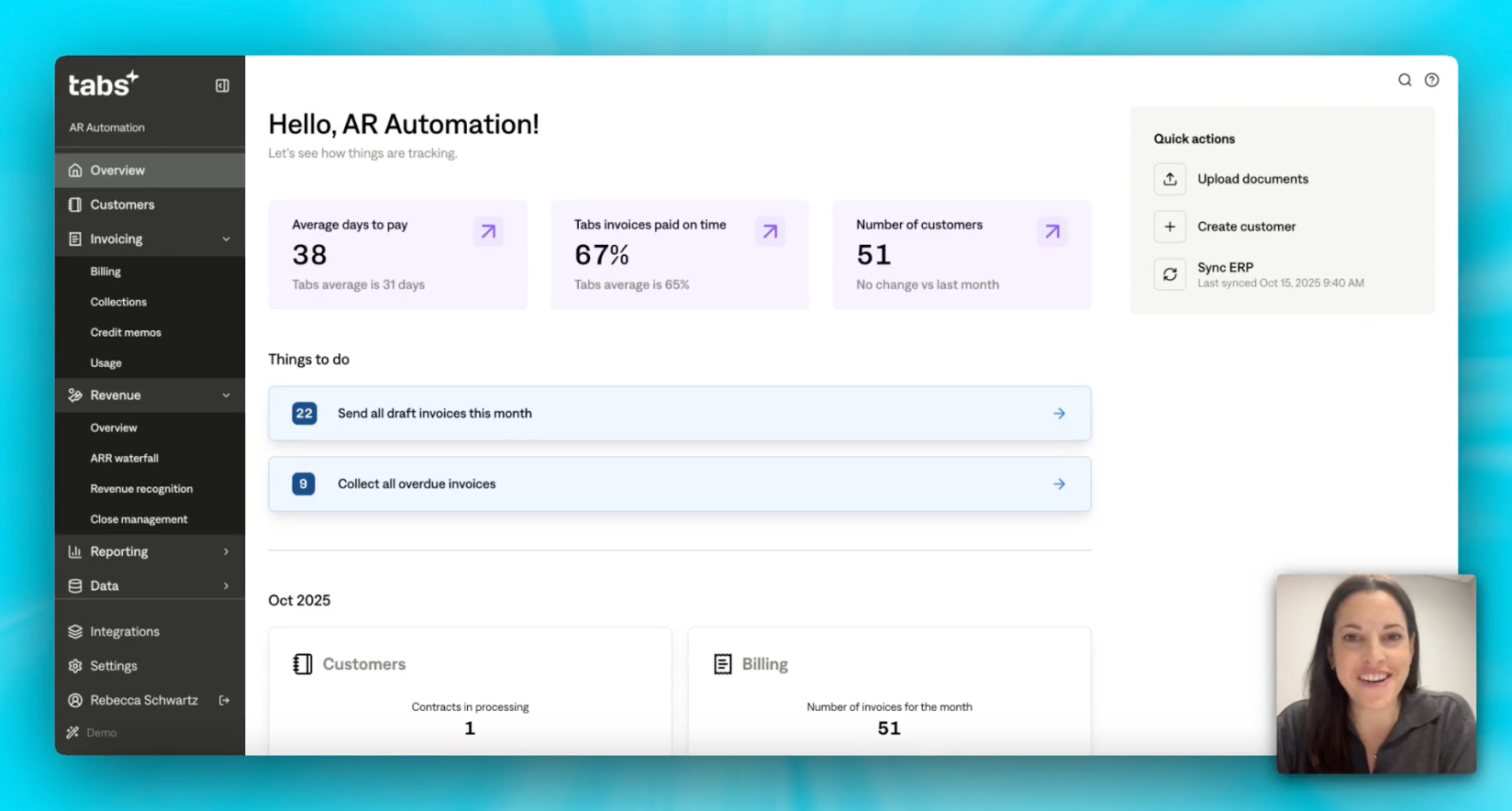

Lean finance teams don’t have the luxury of growing headcount just because revenue complexity increases. With Tabs and Sage Intacct, teams can automate nearly every step of your revenue workflow, from contract ingestion to revenue recognition, reducing time spent on manual billing by up to 80% and minimizing the operational drag that slows down momentum.

With this integration, finance teams can:

- Sync invoices, payments, and journal entries (coming soon) between systems

- Automatically generate draft invoices and billing schedules based on contract terms

- Match payments and reconcile against open invoices

- Automatically generate revenue recognition schedules and ARR waterfalls

- Accelerate monthly close with a one-click push of the subledger to Sage Intacct (coming soon)

Centralize Visibility and Reduce Tool Sprawl

Today, many Sage Intacct users rely on multiple point solutions or spreadsheets to cover billing, collections, rev rec, and reporting. That fragmentation creates multiple versions of the truth and forces teams into manual reconciliation loops.

Tabs eliminates that complexity by bringing revenue under one roof—and syncing directly with Sage Intacct.

With one unified platform, finance leaders get:

- A single source of truth across contracts, invoices, payments, and revenue

- End-to-end visibility across billing and revenue activity across entities (coming soon)

- Fewer systems to pay for, maintain, and reconcile

With fewer moving parts, your team manages less operational friction and gains end-to-end clarity into revenue.

Build a Finance Foundation That Scales With Your Operations

Teams choose Sage Intacct because they’re growing and need a system that can grow with them. Tabs extends that foundation by providing the billing and revenue automation needed to support:

- Multi-entity billing (coming soon)

- Global operations

- Hybrid and usage-based models

- Complex pricing and contract rules

As your tech stack evolves, whether you adopt different tax tools, CRMs, or are contemplating on switching from another ERP to Sage, Tabs is here to integrate, adapt, and scale with you. We’re making bets on best-of-breed product partners so that our customers can rest assured they’re future-proofing tomorrow’s finance operations.

Ensure Compliance and Stay Audit-Ready

Tabs enforces dynamic billing logic and automated revenue recognition aligned to ASC 606, GAAP, and non-GAAP standards across different billing models. Every invoice, payment, and adjustment maintains an audit trail and syncs into Sage Intacct.

Teams get:

- Consistent and accurate revenue reporting

- Audit-ready financial reports without manual cleanup

- Automated tax compliance built into billing workflows with Anrok, Avalara, and *Sphere* (Sphere coming soon)

With Tabs, you can have confidence that every number that flows into Sage Intacct is defensible, traceable, and accurate.

Get the most ROI out of Sage Intacct with Tabs

Tabs and Sage Intacct together unlock what finance teams have been asking for: one connected order-to-cash engine with automation, accuracy, and full operational clarity.

If you’re using Sage and looking for a simpler, faster, and more accurate way to handle order-to-cash, we’d love to chat - request a demo with our sales team today!